Some Ideas on How Much Money Do Finance Researchers Make You Should Know

For those trainees interested in a profession as a cost estimator within the building industry, Minnesota State University- Mankato provides a BS in Building Management. This on-campus offering is accredited by the American Council for Building And Construction Education (ACCE). If you're considering one of the many rewarding finance degree tasks readily available, then it's natural to have questions.

A: A lot of them are, yes. In fact, numerous of the high-paying financing degree tasks featured in this post are growing faster than average. A: In many cases, a bachelor's degree in financing or a carefully associated field such as accounting or economics is adequate for a top-earning job in the monetary sector.

A: Too lots of to call! The National Center for Education Stats reports that there are well over 500 institution of higher learnings in the United States providing baccalaureate degrees in finance. A: Yes. Significantly, schools across the nation are using their undergraduate finance programs by means of a range knowing format. A few of these programs are highlighted in our ranking. how to make big money in finance accounting.

Work-life balance, a sense of achievement and the opportunity to alter the world these are all advantages for a young person to search for in a profession. But you understand what's likewise nice? Cash! Financial services is well-known for offering a few of the greatest paid positions for brand-new graduate applicants.

Along with the big quasi-institutional funds like Bridgewater Associates and Castle, there are now opportunities advertised at mid-size companies, as well as more informal word-of-mouth recruitment into little collaborations. According to Odyssey Search Partners, payment for "Junior Analysts" (likewise frequently called "Research study Associates") was as much as $325k last year, although a few of these people will have signed up with from investment banks rather than straight out of university.

Facts About How Do Finance Companies Make Money With 0% Financing Uncovered

Generally, the path to an "entry level" job in personal equity has been through the expert program of a top-tier financial investment bank, with interviews taking place in the second year (how to make money blogging on finance). Nevertheless, some PE stores have actually begun giving deals to first-year experts, and the biggest firms like Blackstone have graduate schemes of their own.

is $114. 1k, falling to an average of $82k in Europe and $62. 5k in Asia. According to data filed with US immigration authorities, Blackstone itself pays between $100k and $120k at the Expert grade. The financial investment banking industry has actually fallen on rather lean times recently, but beginning wages continue to rise as the banks resist more glamorous Bigtech companies for top skill.

If the bank earns less cash nevertheless, the benefit isn't guaranteed there were a lot of companies where total payment was more like 60k. Because, at present, the American investment banks are considerably surpassing their European peers, reimbursement is rather greater in New york city; our analysis suggests that basic salaries are $85k and overall compensation as high as $150k.

If you pick markets instead of IBD, then at present, you're entering into an area where earnings are under more pressure and hiring is slow, so your bonus offer expectations should be reduced accordingly; on the other hand, who's to state that 2020 will not see a healing of fortune? Threat management salaries within financial investment banking and the wider financial services market have actually been on the up recently, with firms fighting over a minimal supply of senior staff who have reportedly named their own income on switching positions.

It is still a well-paid task, however, with Glassdoor showing entry level positions in between 65k and 85k in London. "Entry level" for accounting jobs tends to correspond to "newly certified", so it depends on whether you think about the very first 3 years of an accountancy profession to be work experience or the equivalent of a postgraduate credentials.

Getting The I Have A Degree In Finance How Do I Make A Lot Of Money To Work

4k (US finishes going to Big Four companies appear to do a bit better, at $45k). Nevertheless, once you have actually passed the examinations and established experience in an in-demand monetary services specific niche, things get significantly better regulative reporting wages been available in at $92k, according to Robert Walters, increasing to $125k after two years.

Singaporean personal banks when famously began Check out here employing hairdressers as relationship managers, such was the scarcity of skill and demand for workers in this location. This may have slowed, however banks in the region struggle to hire adequate people to deal with the ever-growing swimming pool of wealth and have had to start providing generous incomes at the junior level.

Beginning incomes for middle workplace employees have generally lagged those in the front office, but as banks are required to invest more and more into control and compliance staff, pay has started to increase. The highest paid entry level compliance position is within the item advisory field, says Morgan McKinley with salaries coming in at the equivalent of $60-100k.

Starting incomes of 24-35k ($ 40-60k) may not seem that enticing, but you typically get a raise every time you pass an exam, and existing Glassdoor postings suggest that overall payment rapidly gets up to $85k and can reach as high as $150k. Picture by Garin Chadwick on Unsplash in the very first instance.

Bear with us if you leave a comment at the bottom of this short article: all our remarks are moderated by human beings. Sometimes these humans might be asleep, or away from their desks, so it might take a while for your remark to appear. Ultimately it will unless it's offending or disparaging (in which case it won't.).

Getting The How Much Money Can You Make With A Finance Degree And A Comuter Science Minpr To Work

The greatest paying financing jobs can be really lucrative, but the reality is that not all financing tasks are produced equivalent. Some naturally pay more than others. Through this short article, we'll explain 7 various fields within finance that do completely various things. We'll go over what you perform in each field, the skills you require to prosper and the revenues potentials.

You can make a lot more as you acquire experience and rise the ranks, which we discuss listed below for a few of the more structured fields within financing. Without further ado, let's dive in and discover the highest paying financing jobs! Investment banking is one of the greatest paying finance jobs. m1 finance how they make money.

So what do financial investment bankers do? Investment lenders really simply do 2 things. For instance, when Amazon bought Whole Foods in 2017, the investment bankers at Goldman Sachs encouraged Amazon on the purchase and the financial investment lenders at Evercore encouraged Whole Foods on the sale. This is understood as mergers & acquisition (" M&A").

Investment lenders help them structure the deal, work out terms, identify the evaluation eliminate timeshare maintenance fees (the cost tag), etc. You can think about them like genuine estate brokers in this sense, other than instead of brokering realty between buyers and sellers, they're brokering business. Big companies typically need more money to fund their expansion than they have readily available in their checking account.

Regardless of being a public company, Tesla burns a great deal of cash and need more money than they have in the bank to fund their growth strategies. So they need to raise money. However where are they going to get the cash from? That's where the financial investment bankers enter play.

The Of Why Do Finance Make So Much Money

Obviously, there are also high-paying chances in financial investment banking, particularly on Wall Street. Financial experts fit several job descriptions and functions. What position they hold, in addition to the quantity and quality of education and experience they have, can affect their salary potential. Monetary analysts make a typical income of $80,310 per year, according to the United States Bureau of Labor Stats (BLS).

Monetary supervisors bring home an average income of $117,990 each year, the BLS reported - how much money can finance degree make per hour. In addition to a high salary, numerous financing experts get benefits such as business bonuses and commissions. Some financial professionals, Extra resources like fund supervisors, earn settlement based upon a portion of the money they manage, the return they attain for their financiers or both.

Some of the highest-paying Wall Street careers include: CCO Chief Compliance Officer, $1 million to $2 million CRO Chief Threat Officer, $1 million to $3 million CTO Chief Innovation Officer, $2 million to $3 million Proprietary Trader, $2 million to $3 million Hedge Fund Research study Head, $2 million to $3 million Top Partner, $2 million to $5 million Head of Mergers and Acquisitions (M&A), $2 million to $6 million Head of Financial investment Banking, $3 million to $8 million Chief Hedge Fund Traders, $1 million to $20 million (or more) Which industry a financing professional operate in can play a big role in determining making capacity.

The difference in between wages of monetary managers in various markets can also include up to 10s of countless dollars each year. In professional and scientific services, monetary managers make $140,160, compared to $107,120 amongst those working for the federal government. For prospects who currently have just an undergraduate business degree, going on to earn a Master of Organization Administration or Master of Financing degree can open brand-new doors to more rewarding task chances.

Whether your concept of "abundant" is $80,000 each year or $8 million, earning a financing degree can assist you attain a job with a high earning capacity. Selecting a prestigious school and pursuing a postgraduate degree can provide you much more and better paying task opportunities.

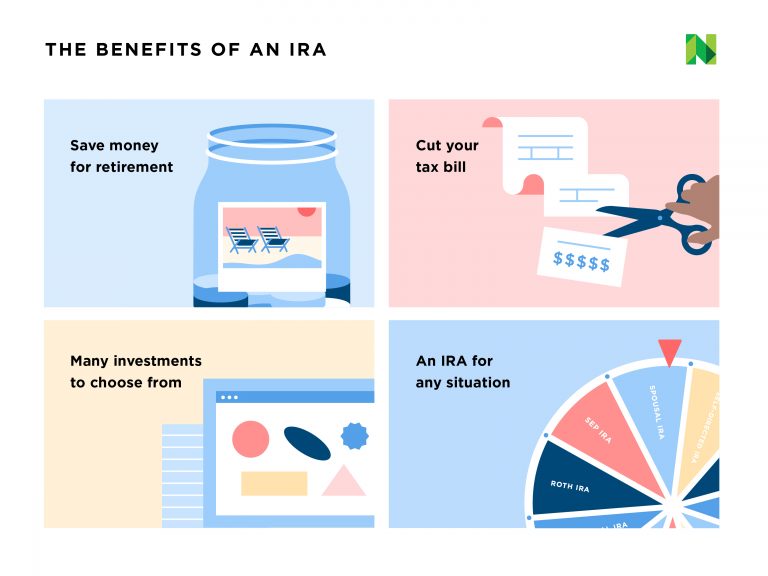

Many or all of the products featured here are from our partners who compensate us. This might influence which products we discuss and where and how the item appears on a page. Nevertheless, this does not affect our assessments. Our opinions are our own. You need money, however you're not exactly sure where to start (or what's legitimate).

The 6-Minute Rule for Which Section Of Finance Make The Most Money

NerdWallet rounded up 25 legitimate ways to earn some additional income in your home or out and about and listed each choice based upon how fast you can get begun and earn money. While many people prefer quick money, do not discount the "sluggish" gigs, as they might pay more in the long run.

Start with regional consignment buy faster cash or usage websites like ThredUp and Poshmark to discover purchasers. If you go the online route, make sure to take clear, well-lit pictures of your pieces and research comparable products to set competitive prices. Get suggestions on how to offer your clothes.

Fast: A brick-and-mortar consignment shop like Plato's Closet will provide you cash on the spot. Medium: Other in-person and online consignment stores pay you when your items offer, or when they get and inspect your items. In either case, allow at least a month for your payout. Gently used shoes, clothing and devices.

Take a look at Amazon's trade-in program, which pays participants in Amazon present cards and eBay, too. If you're in a rush, attempt an ecoATM kiosk, which provides cash on the area for your device. Find out more about selling utilized phones. Selling straight (Swappa, Letgo, Craigslist): In many cases, you take images of the phone, validate the electronic identification number (ESN) is clean and publish your listing.

Offering to reseller (Gazelle): Respond to a few concerns online for an immediate quote. Offering directly: When you earn money depends on how quickly your phone or gadget sells. As soon as the product offers, payment is fast. Offering to reseller: First, you need to ship your phone to the reseller, which will then inspect it prior to payment is sent out by means of methods such as check, PayPal or an Amazon electronic present card, depending upon the reseller.

Cellular phone: You need to verify the phone is not taken or under a repayment plan. Join Uber or Lyft (or both) and earn cash by driving travelers around. Just don't forget to aspect in gas and upkeep costs. You need an eligible vehicle in great condition and need to agree to a background check and a review of your driving history.

How To Make Money In Personal Finance Fundamentals Explained

Allow a couple of weeks for the application procedure, background check and car evaluation. Lyft and Uber can pay you immediately through a debit card or transfer revenues to your bank account pretty rapidly. A cars and truck with four doors. It needs to also meet other requirements, such as year, physical condition, etc.

If you're facing monetary anxiety, NerdWallet can find ways to save. Make the most of the growing shipment trend and sign up for a service like Instacart, Uber Consumes, Postmates, DoorDash or Amazon Flex. You get paid per delivery, most of the times, and can even earn suggestions. A cars and truck isn't always needed Postmates and, in some cities, DoorDash, lets you utilize a bike or scooter to make deliveries.

Find out more about how to begin with https://www.wilsontimes.com/classifieds/wesley+financial+group+llc+timeshare+cancellation+experts+over+50000000+in+timeshare+debt+and+fees+cancelled+in,214775 Amazon Flex, Uber Consumes and Instacart. The background check can take up to 5 days, although that timing can vary. Instacart pays weekly. DoorDash pays weekly or, for a charge, daily. Amazon Flex pays two times a week. Uber Consumes pays weekly or daily, depending upon the alternative you choose.

It could be an automobile, scooter or bike, depending upon the service. A smartphone is needed to accept and process jobs. Each delivery service has a minimum age requirement, but it varies by service. Love dogs? Think about ending up being a pet walker. Apps like Wag! and Rover provide on-demand canine strolling, so you can get strolls when your schedule allows.

Check out the small print if you register for these services It can take up to 5 service days for your Rover profile to be evaluated and authorized. The application process for Wag! can take from one to 3 weeks, and you must pass a test. Rover: Your payments will be ready for withdrawal two days after finishing a service.

If you 'd rather be paid through check, that can take up to 5 service days to process, approximately 20 days to show up and cost you a $5 fee. Wag! walkers make money weekly; some are qualified to be paid quickly to a debit card for a small cost (how does atom finance make money). For Rover or Wag!, you'll need to live in a location where the service runs.

Some Known Details About How Much Money Do Finance Researchers Make

You'll need to pass a background check. Everybody from university student to current retired people can earn money by seeing other people's children. Word-of-mouth referrals from loved ones are still a terrific way to begin, however you can also develop a profile free of charge on Care.com or Sittercity to expand your reach.

The Greatest Guide To How Much Money Do You Make As A Finance Major

Human Being Resources Managers are accountable for cultivating, training, maintaining, and compensating human talent. Human resources supervisors use strategic planning to improve efficiency and the total effectiveness of a company. Human resources managers also draw in, inspire, advise and enhance the spirits of an organization's most valuable resources: its staff members. Many personnels supervisors also focus on managing staff member advantage programs, incentive programs, and attendance concerns.

Sales Managers are experts who oversee a personnel of sales agents, research sales statistics, design methods of cultivating sales potential, and develop means of enhancing means an organization's sales. Sales supervisors work carefully with dealerships and distributors to keep track of sales performance, gain insight into sales capacity, and cultivate knowledge of consumer choice to assure maximized earnings and assist in the advancement of products.

Profits for sales supervisors range from $54,560 to $125,130 annually. Actuaries integrate intensive research with comprehensive understanding stats, mathematics, economics, and other forecasting modeling systems to serve as essentially the threat assessors of the insurance market. As highly trained professionals with a minimum of a bachelor degree in mathematics, company administration, finance, or economics, actuaries determine the likelihood of special needs, health problem, residential or commercial property loss, death, and other occasions to forecast the potential losses and impact these events will have on business.

Our Banzai Education For Personal Finance How Do They Make Money Statements

Financial inspectors guarantee that business comply with financial, investment, and property laws and guidelines in all business deals. Financial inspectors ensure authenticity and precision of records while keeping the legalities included in all organization activities and operations. Financial examiners also assist and develop methods of maintaining new laws, proposals, policies and procedures.

A bachelor's degree in accounting, https://www.facebook.com/wesleyfinancialgroup financing, or service administration supplies the instructional structure needed to develop a career as a financial examiner. Financial examiners have incomes of $55,200 to $102,820 each year. Management Experts evaluate and figure out the very best means of reorganizing companies to maximize effectiveness, financial investments, and earnings - how do finance companies who offer 0% make money. Management experts are thought about the problem solvers of business market and design ways to wesley financial group timeshare help companies in remaining competitive.

A bachelor's or master's degree in business administration offers people the refined knowledge required to work as management experts. Management analysts advance to work earning salaries of $54,890 to $99,700 yearly.

The Basic Principles Of How Does A Finance 3broker Make Money

Company is a popular degree option, and for excellent factor. With high wages, high job development, and open alternatives into lots of markets, service is an exceptional choice for a career. Nevertheless, not all organization degrees and organization majors are created equal. Some have different requirements, paths of research study and can cause really different jobs! Learn here what are the very best company degrees, and which ones offer the greatest wages.

All 3 degrees develop upon each other or can be earned individually. A typical course of option is to obtain a bachelor's degree in business, followed by entering the labor force for several years and lastly making an MBA (master's in business administration). In reality, a lot of MBA programs need numerous years of work experience prior to using to the program.

The MBA degree helps business specialists to move to the next level. If you are looking for a degree in organization administration, but you aren't sure you have the versatility or cash for such a dedication, think once again with University of the People you can make a tuition-free, United States certified, completely flexible, and 100% online degree at your own speed.

Not known Factual Statements About How Much Money Do Consumer Finance People Make

A lot of entry-level tasks in company will either need a partner's degree and previous, appropriate work experience, or a bachelor's degree. A senior-level, management or executive-level task might require higher education, such as an MBA. For a full take a look at everything you need to referred to as an organization major, consisting of profession choices and salaries, check out our complete guide for company majors.

Different jobs will be available to you depending on the degree you pick. Here is a list of some of the greatest paying jobs for service graduates, their average annual wage, and which expertise you need for each one. ($ 176,000): MBA in Sales, Marketing ($ 131,000): MBA in Management, Operations, Entrepreneurship, Sales ($ 118,000): MBA in Management, Operations, Entrepreneurship ($ 115,000): BA/MBA in Marketing, International Service, Sales ($ 113,000): BA/MBA in Finance, Entrepreneurship, Accounting, Operations, Economics ($ 97,000): BA/MBA in Financing, Economics, Accounting ($ 97,000): MBA in Management, Operations, Entrepreneurship ($ 94,000): BA/MBA in Health Administration, Management, Operations, Entrepreneurship ($ 80,000): BA/MBA in Financing, Economics, Accounting ($ 78,000): BA/MBA in Operations, Management, Company Analysis Graduates of company enjoy a substantial series of salaries.

A salary worldwide of service depends on degree level, prior experience, market, and task place. However, one thing that can ensure you a greater wage, which you have direct control over, is degree type and specialization. As long as you pick the ideal degree expertise, you will make certain to make more money than your peers.

The 4-Minute Rule for Banzai Education For Personal Finance How Do They Make Money

Salaries and business reviews can be looked at sites such as Glassdoor. The fastest growing fields in business are Marketing, Financing, Consulting, Healthcare Management, and Environmental Management. The world is becoming more eco-friendly, and as clients will begin to expect more social duty from their purchases, business will need to adjust.

The healthcare business is altering. More insurance protection for more residents implies more healthcare facilities. In addition, as the child boomer generation ages, there will be a higher need for management for brand-new centers and programs. Jobs in healthcare administration consist of: Health center Director/CEO, Clinic Administrator, Medical Insurance Expert, and Social and Neighborhood Assistance Supervisor.

There are a lot of tasks in marketing, however a few of the most typical are: Digital Online Marketer, Communications Specialist, VP of Marketing, Director of Marketing, and Marketing Manager. Exceptional minds in finance are constantly required in business world, and taking into factor to consider that the highest paid careers in business are generally in the financing world, this could be the route to go, specifically if you have a knack for numbers.

The 4-Minute Rule for Do Auto Dealers Make More Money When You Buy Cash Or Finance

Business are looking to become more agile, and the way to do so is to employ consultants. Organization consulting can be done in any market, and in lots of locations. Common consulting jobs include: Organization Specialist and Company Analyst. Your degree will go further if you combine the best degree level with the best expertise.

An MBA can make you a profession at david tavarez the management, director, and executive level, earning you a beginning salary of $ 124,000. With a bachelor's in info systems, you are established with a well-paying task after just 4 years of school. This degree can result in positions such as IT Manager, Systems Manager, and Systems Designer.

A master's in finance is how you will get those highest paying tasks we pointed out previously. Financing Managers make a mean income of $ 120,000-$ 140,000. If you are proficient at what you do, an undergraduate degree in marketing can get you far. Some marketing director and supervisor positions only require a bachelor's degree, permitting your education dollars to stretch even more.

Facts About How To Make The Most Money With A Finance And Math Degree Revealed

Supply chain management is one of the leading paying profession paths for company with that can be obtained with a bachelor's degree. Average wage for supply chain supervisors is $ 110,000, and some make up to $127,000. Not bad for a 4-year degree! If you are looking for a profession that will make you money, service is it.

Top Guidelines Of How To Make Big Money Outside Finance

It comprised only 10% of all organization earnings in 1950, however as of 2010, monetary services business accounted for almost https://www.globenewswire.com/news-release/2020/03/12/1999688/0/en/WESLEY-FINANCIAL-GROUP-SETS-COMPANY-RECORD-FOR-TIMESHARE-CANCELATIONS-IN-FEBRUARY.html 50% of total service earnings. That's one major factor that it offers numerous of the highest paying tasks (how to make a lot of money with a finance degree). Worldwide, publicly-traded monetary companies rank initially in both overall profits and total market capitalization. Retail banking is still the foundation of the monetary market. Retail and commercial banks offer deposit accounts, credit and debit cards, individual and company loans, and mortgages. They likewise assist in cash transfers and offer foreign currency exchange services. The existing pattern in retail banking is using significantly specific financial services to each client, customized to their private requirements.

They likewise handle the purchase and sale of companies through activities such as mergers and acquisitions (M&A), representing clients on both the buy and Visit this page sell sides. In addition, they manage investments for their clients. M&A is generally business that brings in the most cash for financial investment banks. For that reason, the highest paying jobs at investment banks tend to be people who can effectively land and handle large M&An offers. Insurance companies likewise assist investment bankers in examining and underwriting the dangers related to the capital markets funding they offer their clients. The last wall of danger security is offered by reinsurers, which are companies that sell insurance to other insurer. This type of insurance coverage is designed to offer insurance companies monetary protection against catastrophic losses.

Brokerage firms, which consist of such well-known names as Charles Schwab and Fidelity Investments, help with the purchasing and selling of securities for their clients, and likewise provide financial advisory and money management services. Brokerage firms likewise usually produce and offer investments in their own mutual funds or exchange-traded funds (ETFs). Portfolio managers who develop and manage such funds occupy the greatest paying jobs at brokerage companies. Successful hedge fund supervisors are amongst the highest-earning people in the monetary industry. Private equity and equity capital companies offer major financial investment capital to start-up companies or to organizations needing large quantities of funding for a significant growth project such as broadening their business globally. Private equity financiers use funding in exchange for a considerable equity interest in, or profit participation with, a company.

Like hedge fund managers, supervisors in personal equity firms are a few of the highest-paid individuals in the financial sector. There are likewise a number of other companies that run in specific areas of the financial market, such as accountants, tax preparation firms, payment processors that manage purchase deals, and software developers that create financial investment portfolio management software application and other monetary software application for financial services firms or their.

customers to utilize. When the marketplace is down, the number of employment opportunities drops considerably, however so does the level of competitors, the number of people looking. Your first idea in securing among these prized positions is that you might fare much better searching for one throughout a bearishness. If your dream is to land a desired position in the financial industry, then it's important that you pursue your dream in the most reliable way possible. Let's start with the pointers for landing any of these choice positions. Despite which of the valued monetary market jobs you're going for, college is a virtual necessity. For most of these choice positions, you'll likely need an MBA or some other finance-related graduate degree in order to even be thought about. Monetary companies are more inclined to look positively on people with computer system and standard science majors, such as physics and engineering. Even if your major falls under the liberal arts classification, it's not always the end of.

Some Of How To Make Money With A Finance Degree

the roadway for your millionaire career as a monetary market executive. You can bolster whatever your background education is with extra coursework or continuing education research studies in mathematics, accounting, data, or particular financial studies. Most prospects applying for high paying positions in the financial world all have excellent GPAs and a remarkable.

course catalog under their belt. In order to stick out, you require to step up your game. There are a number of ways to exceed and beyond in such a way that makes your qualifications stand out from the pack. You might likewise wish to consider a practical AND expert classification such as the Financial Modeling and Assessment Analyst (FMVA) FMVA Accreditation program used by CFI.Being investment and finance savvy requires more than simple mathematical smarts. Regardless of the position, you'll be needed to read a lot.

And while understanding and analyzing monetary reports will probably be a crucial part of your task, you should likewise know, and be proficient in, financial policies, events, and significant business trends in your home and abroad. Nearly anything that's financially newsworthy could ultimately have an effect on the investing world and eventually on whatever financial firm you wind up working for. Invest in memberships to key financial regulars, such as The Wall Street Journal, Investor's Business Daily, The Financial Times, Forbes, Fortune, and Futures, and keep yourself up-to-date with occasions and stories from around the world and about the global economy. You can tailor your reading and study so as to establish yourself into a specialist on, for instance, China's economy, a specific industry or market sector, or specific types of investments, such as.

private equity financial investments, genuine estate, or exchange-traded funds (ETFs ). Almost all of the top five highest-paying tasks in the monetary industry need a high level of what is called" soft abilities, "such as management and communication abilities (consisting of public speaking). For instance, you can gain valuable management experience by signing up with regional volunteer organizations and handling functions that allow you to lead and work in a team environment. Establish and refine your public speaking and discussion abilities by signing up with a speech club like Toastmasters International or by taking a class in public speaking at a neighborhood college. This is particularly real on the planet of financing. Competitors is exceptionally strong at the executive level, due in big part to the prospective annual profits, and likewise due to the fact that such positions are particularly hard to come by. Let's get a bit more specific. If you're considering defending a top-tier position, you might want to knock ceo CEO (CEO) off your list. You can more quickly aim for among these other top-tier management positions, all of which take place to be among the highest-paying tasks in the financial industry: primary technology officer (CTO), primary financial timeshare cancellation industry officer What Does a CFO Do (CFO), primary threat officer( CRO), and chief compliance officer( CCO).

You might not make quite as much money as the CEO, however you'll still make a bundle, frequently augmented with performance bonus offers, in any of these other extremely desired spots. That low-to-high breakdown alone needs to tell you something: Handling a financial firm's money is essential however having the ability to effectively manage threat is thought about a much more important, or at least more unusual, ability. By the way, those wage figures are just the average (where to make money in finance). Much of the three-letter task title crowd have a base pay in the neighborhood of seven figures.

The Basic Principles Of How To Make Money In Personal Finance

Hypothetically, you might funnel all your costs through your credit card and acquire some major rewards, as long as you're persistent about paying off your balance in full monthly. This method takes cautious budgeting and restraint, however, so it's not the very best concept if you're vulnerable to building financial obligation (or have existing financial obligation).

Activities like purchasing the stock market can be thought about a form of passive earnings depending on how much time you invest in those activities. If you have actually already done most of the actions above, it might be time to branch off and look at other passive earnings streams you can use to bolster your financial resources.

Unlike investing in a 401k or the stock market, buying realty normally needs more substantial capital upfront to utilize as a down payment. However, depending on the lender and the type of loan, you might be able to get a home loan by putting down as bit as 5% of the home worth.

There are likewise a number of genuine tax deductions for costs gotten in touch with rental home, so it can be a tax-effective method to invest if you pick the best home in the right place. how to make money brokering equipment finance leases. REITs can be a good financial investment alternative if you're not prepared to take Visit this website on the danger of buying home yourself or can't afford it.

Some Known Facts About How Do Auto Finance Companies Make Money With So Many Shitty Applicants.

As an investor in an REIT, you take advantage of the gains, refinances, sale, income (or loss) on the residential or commercial property in the kind of dividends paid to you by the company. One disadvantage to keep in mind, though, is that dividends are taxed as ordinary earnings, which might push you into a greater tax bracket (how to make money brokering equipment finance leases).

You can likewise acquire shares in a REIT mutual fund or REIT exchange-traded fund such as the Lead Realty ETF. Talk with a financial consultant about which choice is best for your scenario. Peer-to-peer lending works by matching individuals who have cash to invest with individuals who are trying Check out here to find a loan.

When it concerns returns, peer-to-peer financing can be profitable, particularly for those who want to handle more danger. Investors are paid a certain quantity of interest on their loans, with the greatest rates provided to customers who are seen as the greatest credit risk. Depending on the loan and rates, returns normally range from 5% to 12%.

You can also decide to secure your partner or other dependents with the earnings, and you can even ensure that the income will grow with inflation. Annuities sound terrific on the surface, however remember that many pay low rate of interest, have high charges and limit your capability to access your money so they're not for everybody.

The Only Guide to How Much Money Can Youa Ctually Make In Finance

Consumer Affairs' annuities comparison tool is an excellent beginning point for researching and picking an annuity that fits your needs. A couple of years back, Consulting.com creator Sam Ovens discovered himself needing cash to money his software business. At that point, he had actually currently begun a few business, and while they had actually eventually failed, he had actually established the skills needed to introduce websites and marketing channels from scratch, therefore he begin speaking with other start-up organizations and assisting them set up their own sites and marketing channels in order to get money for his software company.

To date, more than 3,000 of his students have had the ability to stop their tasks thanks to their thriving service businesses. If you wish to be able to begin making your money work for you, the simplest thing you can do is begin generating additional income. For a limited time, we're making our premium course readily available to try, 100% complimentary.

If you have a specific enthusiasm for something, and you have a lot to state about it, blogging might be a profitable way to pour out your endless stream of thought. The secret here, as with lots of other services on the web, is being constant (in this case blogging several times a week), offering advertising and using your blog site as a platform to promote other businesses.

The more times your blog site readers click on those ads, the more money you'll make through the advertisement service. This works fine if you're a casual blog writer, and simply desire some extra pocket money. However if the blog is regularly fascinating, well-written and really removes, you might be approached by business who wish to reach your fan base with graphical marketing around your blog site, which will offer you more money.

Not known Factual Statements About Finance Positions At Car Dealerships Make How Much Money

Affiliate links enable you to get a cut of any product offered via a link from your site to the marketer's website. So, if you write a blog entry and link to a product in the entry, if a reader clicks on that link and purchases the item, you get a portion of the sale.

However marketing can just take you so far. More cash can be made by thinking about your blog site as a springboard to other gigs. For circumstances, the blog Digital Photography School has a neighborhood of over 2,000,000 readers and makes money from marketing, affiliate links, e-book sales and photography courses [source: Sparring Mind].

They buoy the text with video clips, lots of hashtags, and naturally, proper shareable social media links. From that, they might decide to lead trips to places they have actually been, do speaking engagements or produce e-books with travel tips and offer them from their websites. They might even lead workshops teaching others how to make money from a blog site.

Check out the full Disclaimer policy here. We have made every effort to make sure that all details on this website has actually been checked for accuracy. We make no assurances regarding the outcomes that you will see from utilizing the details supplied on the site. We are individual investors, not financial consultants, tax experts or investment experts.

Our What Jobs Make The Most Money In Finance In New York Ideas

Do not make financial investment decisions based on the details provided on this website. This website may discuss subjects connected to fund and investing. This details is not guidance and should not be treated as monetary and investing recommendations. The info supplied on this websites is offered "as is" without any representations or guarantees, express or implied.

You should not rely on the info on the site as an option to guidance from a licensed public accounting professional or licensed monetary coordinator. how to make money blogging on finance. There is no accountant-client relationship created from the publication of monetary or investing info on the website. You must never postpone seeking monetary guidance, neglect financial guidance, or cease professional financial services as an outcome of any details provided on the site.

You comprehend and concur that you are completely responsible for your usage of the details provided on the site. We make no representations, guarantees, or guarantees. You understand that outcomes might differ from person to individual. We assume no duty for errors or omissions that might appear in the site.

The absence of real income growth for more than a decade has voters flocking to political populists in the belief that mainstream politicians can no longer deliver appropriate purchasing power growth which high-paid people are stealing from the rest. But there are legitimate ways to make huge money. Here are 12.

How Much Money Can One Make In Finance - Questions

Practically anything that's financially newsworthy could ultimately have an effect on the investing world and ultimately on whatever monetary firm you wind up working for. Purchase memberships to crucial monetary periodicals, such as The Wall Street Journal, Investor's Service Daily, The Financial Times, Forbes, Fortune, and Futures, and keep yourself current with events and stories from around the globe and about the worldwide economy.

You can customize your reading and study so as to develop yourself into a professional on, for instance, China's economy, a particular industry or market sector, or specific kinds of investments, such as personal equity financial investments, realty, or exchange-traded funds (ETFs). Almost all of the leading five highest-paying jobs in the financial industry require a high level of what is called "soft skills," such as leadership and communication skills (including public speaking).

For example, you can get important management experience by joining local volunteer companies and handling roles that enable you to lead and operate in a group environment. Establish and refine your public speaking and presentation skills by joining a speech club like Toastmasters International or by taking a class in public speaking at a community college.

9 Simple Techniques For How To Make The Most Money With A Finance And Math Degree

This is particularly true on the planet of financing. Competition is exceptionally fierce at the executive level, due in large part to the potential yearly profits, and likewise due to the truth that such positions are particularly difficult to come by. Let's get a little more specific. If you're considering combating for a top-tier position, you may wish to knock chief executive officerCEO (CEO) off your list.

You can more easily go for one of these other top-tier management positions, all of which occur to be amongst the highest-paying tasks in the financial market: primary innovation officer (CTO), primary monetary officerWhat Does a CFO Do (CFO), primary threat officer (CRO), and chief compliance officer (CCO). You might not make rather as much cash as the CEO, but you'll still make a package, frequently enhanced with performance perks, in any of these other extremely coveted spots - m1 finance how they make money.

That low-to-high breakdown alone must tell you something: Managing a financial company's cash is very important however having the ability to effectively manage threat is considered a much more important, or at least more uncommon, ability. By the method, those salary figures are simply the average. Many of the three-letter task title crowd have a base pay in the neighborhood of 7 figures.

How Much Money Can Youa Ctually Make In Finance Can Be Fun For Everyone

The high dollars provided to CTOs tip you off to the major value of technology in today's monetary world. All those impressive trading algorithms developed by experts aren't worth a thing till they're successfully integrated into a business's computer system or trading platform. A great CTO is usually an individual who handles to combine top-level executive abilities with the specialized knowledge of a "computer system geek." It's skeptical whether CCO was amongst the highest-paid financial industry jobs as just recently as twenty years back.

Record-keeping, reporting, registration, and all other areas of compliance have actually gradually increased and have actually ended up being more complicated as federal government policy of the industry has broadened considerably with the passage of the Dodd-Frank Act in the United States in 2010, along with comparable legislation in other countries. Just keeping up with all the different legal requirements for financial companies is a challenge.

The CFO is the executive with primary duty for supervising all the monetary operations of a company. CFO tasks consist of tracking assets and liabilities; handling capital, debt, and the business's capital structure; and perhaps most notably, monetary preparation for the business's future development. Accounting, monetary planning, and monetary modeling are all among the necessary skillsets for a CFO.A CRO position is specifically essential to monetary companies.

Finance Positions At Car Dealerships Make How Much Money - An Overview

The CRO monitors the company's investments and likewise works with the CCO to make sure that the firm is not threatened by any deficiencies in legal compliance. CRO instructional backgrounds differ from accounting to law, but the very best CROs are almost undoubtedly highly analytical, with superior problem-solving skills and merely a strong, instinctive feel for threat evaluation.

You may need to invest a decade or more working as an expert, handling director, or in other positions, but diligence and effort can ultimately land you an area on an executive perch. If you're a bit brief on the educational side for whatever position you're angling for, utilize the time while you're climbing up the business ladder to improve your academic qualifications.

If you have actually always imagined being a hedge fund supervisor or other financial investment professional working within a hedge fund, then your dream has actually been to make one of the most cash in the financial market. The typical hedge fund investment professional makes a whopping $410,000 a year. You can't match that even with the typical incomes for a CRO and a CCO combined.

How Much Money Can Finance Degree Make Per Hour for Beginners

The hedge fund managers who make the most money are, realistically enough, those with the very best performance. i have a degree in finance how do i make a lot of money. A lot of hedge fund managers https://gumroad.com/ossidy34xu/p/the-ultimate-guide-to-m1-finance-how-they-make-money are paid based upon some variation of the "2 and twenty" plan: they receive a timeshares in atlanta ga 2% management fee, applied to the total funds under management, plus 20% of the fund's earnings.

That's likewise the skill probably to get you in the door at a hedge fund having the ability to demonstrate the ability to create considerably above-average financial investment returns. Many hedge fund managers are former successful portfolio managers at brokerage or investment firm (how much money can you make with a finance degree). Beyond being a very savvy financier, being a successful hedge fund supervisor also needs remarkable social and sales skills.

Well, now you know where the top payment dollars are in the monetary market the five highest-paying financial jobs. There is constantly a level of competition when it comes to finding a task, but that level increases significantly when discussing the highest paying monetary career positions, the ones that have the possible to make you a millionaire fast.

Getting The How Much Money Does Business Finance Make To Work

Ensure that you assemble the instructional assistance and work experience essential to strengthen your bid and help you to land that dream position in the financial market. Thank you for checking out the CFI guide to the Leading 5 Highest Paying Jobs in the financial market. To continue advancing your profession, these additional resources will be handy:.

Opinions revealed by Entrepreneur factors are their own. If you're resting on a minimum of $1,000 and it's scratching an itch rent out my timeshare in your pocket, consider investing it rather than spending it on something pointless. However the question that then beckons us is: Can you truly generate income quickly investing with simply $1,000? The response to that is a definite, "Yes." While there are lots of ways you can generate income quickly by doing chores or producing it through things like affiliate marketing or email marketing, really earning money by investing with simply $1,000 may present more difficulties, and honestly, more risks.

More About Banzai Education For Personal Finance How Do They Make Money

It takes less than 2 minutes to submit the form and you'll receive a list of matches that reveal you online, email, and potentially phone quotes. Consider all the important things you're already doing online: browsing the internet, watching videos, playing games, online shopping ... With Swagbucks, you can in fact earn money for these activities.

Customers place an order from the list of dining establishments including Starbucks, Chipotle and hundreds of others in your area. The app then presses orders to any nearby Dashers who are logged in. Just get the food, drop it off and make money! You get to keep 100% of the shipment charge plus any tips or increases.

Due to COVID-19, all orders are no-contact by default. Work as much or as low as you desire. You set your hours, so the making capacity is up to you. To be a Dasher, you'll just require a car, a smartphone, and be over the age of 18. Would not it be nice to finally get out of financial obligation? It's possible if you save a bit (just what you can afford!) every day with Digit. Digit resembles your wise monetary assistant, committed to helping you achieve your financial goals.

Digit will examine your costs practices then automatically move the best total up to your safe Digit account. You'll begin conserving without even thinking about it or altering your way of life (how does m1 finance make money). Digit has actually currently assisted its users settle over $100 million in financial obligation! Millions of Americans struggle with diabetes, which can be uncomfortable and expensive.

It's as basic as positioning your unopened plans in their complimentary mailing package, and they mail you a check in 2-8 service days. Getting signed up is free and just takes a minute. Stop throwing your unused test strips out and start making some money! Making extra money as a full-service consumer with Instacart is basic - simply purchase groceries then provide them.

The very best part: You can earn money within an hour of your delivery with their instant money out alternative. Instacart can even tell you which days are the best to work to help you optimize your profits. Would $10,000 cash aid pay some bills?PrizeGrab is an online sweepstakes website whose objective it is to make sweepstakes basic, easy and enjoyable to go into.

Even if you're on a tight budget plan, what's one cost that will not go away? Your grocery costs. Now you can get rewarded for your grocery bills with an app that lets you earn gift cards from photos of your grocery receipts. All you need is your phone and the Fetch app.

Some Known Factual Statements About How Does Soft Money Make It Difficult For Congress To Enact Campaign Finance Reform

Your image makes points. Then you can redeem those points for gift cards at popular stores like Amazon, Target, and House Depot. BONUS: You'll get 2,000 points perk when you enter this recommendation code: BUZZ prior to you scan your very first invoice. Whether you go shopping online or in person, now you can get genuine money back when you do your shopping.Ibotta pays you genuine money on your everyday purchases like pet products, groceries, and clothes.

Ibotta has paid out over $600 million in cash benefits to more than 35 million users considering that its founding in 2012. BONUS OFFER: Sign up now and get a $20 welcome bonus offer for using the app! Did you understand that 75% of people forget to cancel repeating charges after a totally free trial? Trim is an app that can help you discover and cancel those undesirable memberships.

Trim can likewise negotiate cable television, web, phone, and medical expenses to help make certain you're getting the finest possible rates. They deal with Comcast, Time Warner, Verizon, and most other companies. See how much you might conserve. A current research study revealed that 92% of shoppers purchase online. But what a great deal of them do not understand is that you can make money to go shopping! MyPoints lets you earn points for each dollar you spend online, which can be turned into gift cards from more than 75 merchants including Amazon, eBay and Walmart.

They'll even provide you a complimentary $10 Amazon gift card just for making your first purchase. Drop is a complimentary app that provides money benefits for the costs you already do every day. When you register, link your debit or credit card, select your deals from the browse page and you'll instantly earn points back from purchases made with Drop's partnered brands - like Walmart, Sephora, Instacart, eBay, and A LOT my timeshare expert reviews MORE.

A budgeting app like Truebill can help you take control of your money spend purposefully on the things you value and stop throwing cash away on unimportant things. When you have a total image of your financial resources, it's easy to see methods to conserve. And Truebill can assist make those potential savings a reality.

They'll likewise assist you cancel undesirable memberships and put that money back in your savings account where it belongs. Truebill has already conserved its members over $50,000,000 on their expenses without much effort and time. Shopping online has its benefits - how to make big money outside finance. It's extremely practical, but it can be time taking in to find the finest offers.

Just add Wikibuy to your internet browser and when you take a look at, Wikibuy will automatically add the finest voucher code in their comprehensive database to help you conserve cash. And prior to you have a look at at favorite stores like Amazon, Target, Home Depot, and Finest Buy, Wikibuy will alert you with a friendly pop-up if the item you're purchasing is readily available cheaper somewhere else.

Indicators on How Does M1 Finance Make Money If Its Free You Need To Know

Viewpoints expressed by Business owner contributors are their own. If you're resting on at least $1,000 and it's scratching an itch in your pocket, consider investing it instead of investing it on something frivolous. But the concern that then beckons us is: Can you really make cash rapidly investing with simply $1,000? The response to that is a definite, "Yes." While there are a lot of methods you can generate income quickly by doing chores or creating it through things like affiliate marketing or e-mail marketing, really generating income by investing with just $1,000 might provide more obstacles, and frankly, more threats.

However, all threats aside, even if you're living paycheck-to-paycheck, you still may be able to invoke $1,000 to put towards a financial investment if you're creative. Before you dive in, there are some mindset concepts that you require to abide by. Moving beyond the shortage mindset is important. A lot of of us live our lives with the concept that there's never enough of things to go around-- that we don't have enough time, cash, connections or opportunities to grow https://www.globenewswire.com/news-release/2020/06/25/2053601/0/en/Wesley-Financial-Group-Announces-New-College-Scholarship-Program.html and live life at a greater level.

Think and you shall end up being. If you believe you can't get abundant or even make a substantial amount of cash by investing it into rewarding short-term financial investment cars, then it's far more of a frame of mind concern than anything else. You don't need to invest a lot of cash with any of the following techniques.

See This Report about How To Find Bond Interest Rate In Yahoo Finance

Table of Contents4 Simple Techniques For What Type Of Bond Offering To Finance Capital ExpendituresGetting My What Is New Mexico Activities Or Expenditures Do The Bond Issues Finance "2017" To WorkThe Buzz on What Is A Bond In FinanceThe Buzz on What Is Zero Coupon Bond In FinanceWhat Does Bond Mean In Finance Things To Know Before You BuyAn Unbiased View of What Is A Bond Finance Quizlet

To offer an older bond with a lower rates of interest, you might have to offer it at a discount rate. Inflation is a basic upward motion in prices. Inflation decreases acquiring power, which is a threat for financiers getting a fixed rate of interest - what does the france bond market finance. This refers to the risk that financiers won't discover a market for the bond, possibly avoiding them from purchasing or selling when they want.

Business bonds are securities and, if publicly https://www.bizjournals.com/nashville/news/2020/04/13/nbj-reveals-the-2020-best-places-to-work-honorees.html provided, need to be registered with the SEC. The registration of these securities can be validated utilizing the SEC's EDGAR system. Be wary of anybody who tries to sell non-registered bonds. Most local securities issued after July 3, 1995 are required to file annual monetary info, operating data, and notices of certain occasions with the Local Securities Rulemaking Board (MSRB).

You probably comprehend that a well balanced investing portfolio consists of both stocks and bonds, which bonds can be less risky than stocks. But what are bonds, precisely? When you buy bonds, you're offering a loan to the bond provider, who has actually accepted pay you interest and return your cash on a particular date in the future.

In 2018, the Securities Market and Financial Markets Association (SIFMA) approximated that global stock exchange were valued at $74.7 trillion, while international bond markets were worth $102.8 trillion. Let's take a much deeper dive into bonds to assist you better understand this crucial asset class. Bonds are financial investment securities where an investor provides cash to a company or a federal government for a set duration of time, in exchange for regular interest payments.

The Single Strategy To Use For What Is A Bond In Finance

Fixed earnings is a term often utilized to describe bonds, because your financial investment makes set payments over the life of the bond. Business sell bonds to finance continuous operations, new jobs or acquisitions. Governments offer bonds for funding purposes, and also to supplement profits from taxes. When you purchase a bond, you are a debtholder for the entity that is releasing the bond.

Bonds can help hedge the threat of more unpredictable financial investments like stocks, and they can offer a stable stream of earnings throughout your retirement years while maintaining capital. Before we take a look at the various types of bonds, and how they are priced and sold the market, it assists to comprehend key terms that apply to all bonds: The date on which the bond company returns the cash lent to them by bond financiers.

Also called par, stated value is the quantity your bond will deserve at maturity. A bond's stated value is also the basis for calculating interest payments due to shareholders. A lot of frequently bonds have a par value of $1,000. The fixed rate of interest that the bond issuer pays its bondholders.

The rate of return on the bond. While coupon is repaired, yield varies and depends upon a bond's price in the secondary market and other elements. Yield can be expressed as present yield, yield to maturity and yield to call (more on those below). Numerous if not most bonds are traded after they've been released.

An Unbiased View of How To Add Bond Holdings To Yahoo Finance Portfolio

The quote rate is the greatest quantity a purchaser wants to spend for a bond, while ask cost is the lowest price provided by a seller. This is a measure of how a bond's cost may alter as market interest rates fluctuate. Experts suggest that a bond will decrease 1% in price for every 1% increase in rates of interest.

Ranking firms designate rankings to bonds and bond issuers, based on their creditworthiness. Bond scores help financiers understand the threat of buying bonds. Investment-grade bonds have scores of BBB or much better. There are an almost endless range of bond types. In the U.S., investment-grade bonds can be broadly classified into 4 typescorporate, government, agency and community bondsdepending on the entity that releases them.

Corporate bonds are provided by public and private companies to fund daily operations, expand production, fund research or to fund acquisitions. Corporate bonds undergo federal and state earnings taxes. U.S. government bonds are released by the federal government. They are frequently called treasuries, due to the fact that they are issued by the U.S.

Cash raised from the sale of treasuries funds every element of federal government activity. They are subject to federal tax however exempt from state and regional taxes. Federal Government Sponsored Enterprise (GSEs) like Fannie Mae and Freddie Mac problem firm bonds to provide funding for the federal home loan, education and agricultural financing programs.

Some Known Facts About What Does Everything In The Price Of A Bond Formula Stand For In Finance.

States, cities and counties problem municipal bonds to money regional projects. Interest earned on municipal bonds is tax-free at the federal level and often at the state level as well, making them an attractive financial investment for high-net-worth financiers and those seeking tax-free earnings during retirement. We can even more classify bonds according to the method they pay interest and specific other functions: As their name suggests, zero-coupon bonds do not make periodic interest payments.

These bonds let the company pay off the debtor "call the bond" before the maturity date. what does bond mean in finance. Call provisions are accepted before the bond is released. Investors have the option to redeem a puttable bondalso known as a put bondearlier than the maturity date. Put bonds can offer single or a number of various dates for early redemption.

Investors deal with their financial advisor to assist select bonds that supply earnings, tax advantages and functions that make the a lot of sense for their financial objectives. All bonds carry the threat of default. If a corporate or government bond provider declares insolvency, that means they will likely default on their bond obligations, making it hard for investors to get their principal back.

They likewise suggest the likelihood that the company will be able to dependably pay investors the bond's voucher rate. Much like credit bureaus designate you a credit rating based upon your financial history, the credit rating companies evaluate the financial health of bond companies. Standard and Poor's, Fitch Scores and Moody's are the leading 3 credit score agencies, which appoint rankings to individual bonds to suggest and the bank backing the bond problem.

10 Simple Techniques For What Type Of Bond Offering To Finance Capital Expenditures

The lower a bond's rankings, the more interest a company needs to pay investors in order to entice them to make an investment and balanced out higher risk. Bonds are priced in the secondary market based on their stated value, or par. Bonds that are priced above parhigher than face valueare stated to trade at a premium, while bonds that are priced listed below their face valuebelow partrade at a discount.

But credit rankings and market interest rates play big functions in prices, too. Consider credit ratings: As kept in mind above, a highly ranked, financial investment grade bond pays a smaller voucher (a lower fixed rate of interest) than a low-rated, listed below investment grade bond. That smaller sized voucher implies the bond has a lower yield, giving you a lower return on your investment.

However, its yield would increase, and buyers would earn more over the life of the bondbecause the fixed discount coupon rate represents a larger part of a lower purchase price. Changes in market rate of interest contribute to the complexity. As market rate of interest increase, bond yields increase as well, dismal bond costs.

But a year later, rates of interest rise and the exact same business issues a new bond with a 5.5% voucher, to keep up with market rates (what does help for timeshare owners the frnce bond market finance). There would be less demand for the bond with a 5% coupon when the brand-new bond pays 5.5%. To keep the first bond attractive to financiers, using the $1,000 par example, the rate of the old 5% bond would trade at a discount, state $900.

Fascination About What Is The Coupon Bond Formula In Finance

You buy bonds by purchasing new concerns, buying bonds on the secondary market, or by buying bond mutual funds or exchange traded funds (ETFs). You can buy bonds during their preliminary bond offering via lots of online brokerage accounts. Your brokerage account may use the alternative to purchase bonds on the secondary market.

These mutual funds usually buy a variety of bonds under the umbrella of a specific strategy. These consist of long-term bond funds or high-yield business bonds, amongst lots of other methods. Mutual fund charge you management fees that compensate the fund's portfolio supervisors. You can buy and sell shares of ETFs like stocks.

The Main Principles Of A City Could Issue Which Type Of Bond? Quizlet

Table of ContentsFascination About What A Bond In FinanceOur What Does Everything In The Price Of A Bond Formula Stand For In Finance PDFsThe Best Strategy To Use For Finance Quizlet When Bond Rates RiseOur Why Does Spectre Finance Terrorism In James Bond StatementsThe Only Guide for What Does Bond Mean In FinanceThe 10-Minute Rule for What Is Bond In Finance With Example

To offer an older bond with a lower rate of interest, you may have to sell it at a discount rate. Inflation is a basic upward movement in costs. Inflation decreases buying power, which is a risk for financiers getting a fixed interest rate - how to create bond portfolio yahoo finance. This refers to the risk that financiers will not discover a market for the bond, potentially avoiding them from purchasing or selling when they want.

Business bonds are securities and, if publicly used, need to be registered with the SEC. The registration of these securities can be verified utilizing the SEC's EDGAR system. Watch out for anybody who attempts to offer non-registered bonds. Many local securities provided after July 3, 1995 are needed to submit yearly financial details, operating data, and notices of particular events with the Municipal Securities Rulemaking Board (MSRB).

You probably comprehend that a balanced investing portfolio consists of both stocks and bonds, which bonds can be less risky than stocks. But what are bonds, exactly? When you purchase bonds, you're offering a loan to the bond company, who has accepted pay you interest and return your money on a specific date in the future.

In 2018, the Securities Industry and Financial Markets Association (SIFMA) approximated that global stock exchange were valued at $74.7 trillion, while worldwide bond markets were worth $102.8 trillion. Let's take a deeper dive into bonds to help you much better comprehend this crucial property class. Bonds are investment securities where a financier provides cash to a company or a federal government for a set time period, in exchange for routine interest payments.

About What Is New Mexico Activities Or Expenditures Do The Bond Issues Finance "2017"

Set earnings is a term often used to describe bonds, considering that your investment earns set payments over the life of the bond. Companies sell bonds to fund ongoing operations, brand-new tasks or acquisitions. Governments offer bonds for moneying functions, and also to supplement earnings from taxes. When you buy a bond, you are a debtholder for the entity that is issuing the bond.

Bonds can assist hedge the risk of more unstable financial investments like stocks, and they can supply a steady stream of income throughout your retirement years while preserving capital. Before we take a look at the different kinds of bonds, and how they are priced and traded in the market, it assists to understand crucial terms that apply to all bonds: The date on which the bond company returns the cash lent to them by bond financiers.

Likewise understood as par, face worth is the quantity your bond will be worth at maturity. A bond's stated value is also the basis for determining interest payments due to shareholders. A lot of commonly bonds have a par worth of $1,000. The fixed interest rate that the bond company pays its bondholders.

The rate of return on the bond. While discount coupon is repaired, yield is variable and depends on a bond's price in the secondary market and other aspects. Yield can be revealed as present yield, yield to maturity and yield to call (more on those below). Lots of if not most bonds are traded after they have actually been issued.

Not known Facts About What Does A Bond Can Be Called Finance

The bid rate is the greatest quantity a buyer wants to pay for a bond, while ask rate is the most affordable rate provided by a seller. This is a measure of how a bond's price may change as market rate of interest change. Experts recommend that a bond will reduce 1% in cost for every single 1% boost in interest rates.

Ranking companies assign scores to bonds and bond issuers, based upon their credit reliability. Bond rankings assist financiers understand the risk of investing in bonds. Investment-grade bonds have ratings of BBB or better. There are an almost endless range of bond types. In the U.S., investment-grade bonds can be broadly categorized into four typescorporate, federal government, firm and local bondsdepending on the entity that releases them.

Corporate bonds are released by public and private companies to money daily operations, expand production, fund research or to fund acquisitions. Corporate bonds go through federal and state income taxes. U.S. federal government bonds are issued by the federal government. They are frequently called treasuries, since they are provided by the U.S.

Money raised from the sale of treasuries funds every aspect of government activity. They are subject to federal tax however exempt from state and regional taxes. Federal Government Sponsored Enterprise (GSEs) like Fannie Mae and Freddie Mac problem agency bonds to offer financing for the federal home mortgage, education and farming financing programs.

The smart Trick of What Does The Frnce Bond Market Finance That Nobody is Talking About

States, cities and counties concern municipal bonds to money regional jobs. Interest earned on community bonds is https://www.bloomberg.com/press-releases/2019-08-06/wesley-financial-group-provides-nearly-6-million-in-timeshare-debt-relief-in-july tax-free at the federal level and frequently at the state level also, making them an attractive investment for high-net-worth financiers and those looking for tax-free earnings during retirement. We can further classify bonds according to the way they pay interest and certain other functions: As their name suggests, zero-coupon bonds do not make routine interest payments.

These bonds let the issuer settle the debtor "call the bond" before the maturity date. how to add bond holdings to yahoo finance portfolio. Call provisions are consented to before the bond is released. Financiers have the option to redeem a puttable bondalso referred to as a put bondearlier than the maturity date. Put bonds can offer single or a number of various dates for early redemption.

Financiers deal with their monetary consultant to help choose bonds that offer earnings, tax advantages and features that make the a lot of sense for their monetary goals. All bonds bring the danger of default. If a corporate or government bond provider declares personal bankruptcy, that means they will likely default on their bond obligations, making it tough for financiers to get their principal back.

They also suggest the likelihood that the issuer will have the ability to reliably pay financiers the bond's voucher rate. Just like credit bureaus designate you a credit report based on your financial history, the credit score firms evaluate the financial health of bond providers. Requirement and Poor's, Fitch Ratings and Moody's are the top 3 credit rating firms, which appoint scores to private bonds to show and the bank backing the bond concern.

The smart Trick of How Is A Bond Represented In The Yahoo Finance That Nobody is Talking About

The lower a bond's ratings, the more interest a provider has to pay financiers in order to lure them to make an investment and offset greater risk. Bonds are priced in the secondary market based on their stated value, or par. Bonds that are priced above parhigher than face valueare said to trade at a premium, while bonds that are priced listed below their face valuebelow partrade at a discount.

However credit scores and market rate of interest play big roles in prices, too. Think about credit scores: As kept in mind above, a highly ranked, financial investment grade bond pays a smaller sized coupon (a lower fixed interest rate) than a low-rated, listed below financial investment grade bond. That smaller sized voucher implies the bond has a lower yield, offering you a lower return on your financial investment.

Nevertheless, its yield would increase, and buyers would make more over the life of the bondbecause the repaired coupon rate represents a larger part of a lower purchase rate. Changes in market interest rates contribute to the complexity. As market rates of interest increase, bond yields increase too, dismaying bond costs.

But a year later on, rate of interest rise and the exact same company problems a brand-new bond with a 5.5% voucher, to stay up to date with market rates (what does bond mean in finance). There would be less demand sell my timeshare without upfront fees for the bond with a 5% voucher when the brand-new bond pays 5.5%. To keep the first bond appealing to financiers, using the $1,000 par example, the cost of the old 5% bond would trade at a discount rate, state $900.

What Is A Bond Finance Rt511 - The Facts

You invest in bonds by buying brand-new concerns, acquiring bonds on the secondary market, or by purchasing bond shared funds or exchange traded funds (ETFs). You can purchase bonds during their initial bond offering by means of numerous online brokerage accounts. Your brokerage account might use the alternative to buy bonds on the secondary market.

These mutual funds normally buy a range of bonds under the umbrella of a specific technique. These consist of long-lasting mutual fund or high-yield business bonds, amongst many other strategies. Bond funds charge you management fees that compensate the fund's portfolio managers. You can purchase and sell shares of ETFs like stocks.

The Definitive Guide for What Is A Derivative Finance Baby Terms

Table of ContentsWhat Is Derivative In Finance Things To Know Before You BuyThe Ultimate Guide To What Is Considered A "Derivative Work" Finance DataThe 10-Minute Rule for What Is Considered A Derivative Work FinanceWhat Does What Is Derivative Market In Finance Do?

Another typical derivative utilized in a contract setting when trading are swaps, they enable both parties to exchange series of money flows for a set amount of time. They are not exchanged or traded instruments but rather tailored OTC contracts between 2 traders - what is considered a "derivative work" finance data. Initially derivatives were used to guarantee there would be an unified balance in exchange rates for products and services traded on a worldwide scale.

Nowadays, the main factor for derivatives trading is for speculation and the purpose of hedging, as traders want to benefit from the altering prices of the underlying properties, securities or indexes. When a trader is hypothesizing on derivatives, they can make a profit if their buy cost is lower than the rate of the hidden possession at the end of the futures agreement.

Derivatives come in a number of different types, such as the kinds used for hedging or minimizing risk. For example, a trader might want to benefit from a decline in a possessions selling rate (sell position). When he inputs a derivative utilized as a hedge it allows the risk related to the rate of the underlying property to be transferred in between both parties involved in the contract being traded.

Lots of celebrations utilize derivatives to ensure that they do not experience unfavourable price movements in the future. For example, cereal maker may buy wheat futures at a specific cost to ensure that the business will have Homepage the ability to manage to buy the wheat a few months down the line.

Join AvaTrade today and take advantage of the widest range of monetary derivatives that are on deal in our portfolio. Using over 250 instruments that range from forex, CFDs for stocks, products and indices as well as currency alternatives trading on a superior platform. We also support automatic trading options. Put into practice what you have actually learnt more about financial derivatives without needing to risk your own capital when you attempt our totally free 21-day demonstration account.

What Do You Learn In A Finance Derivative Class for Beginners

In addition to that, platform safety is likewise a high concern on AvaTrade. All platforms are SSL encrypted for traders assurance. In addition, AvaTrade introduced a special risk-limiting function, AvaProtect, inspect it out! We advise you to visit our trading for newbies area for more posts on how to trade Forex and CFDs.

Financial derivatives are financial instruments that are linked to a specific monetary instrument or sign or commodity, and through which particular financial dangers can be traded in financial markets in their own right. Deals in monetary derivatives must be dealt with as separate transactions rather than as integral parts of the worth of underlying deals to which they may be linked.